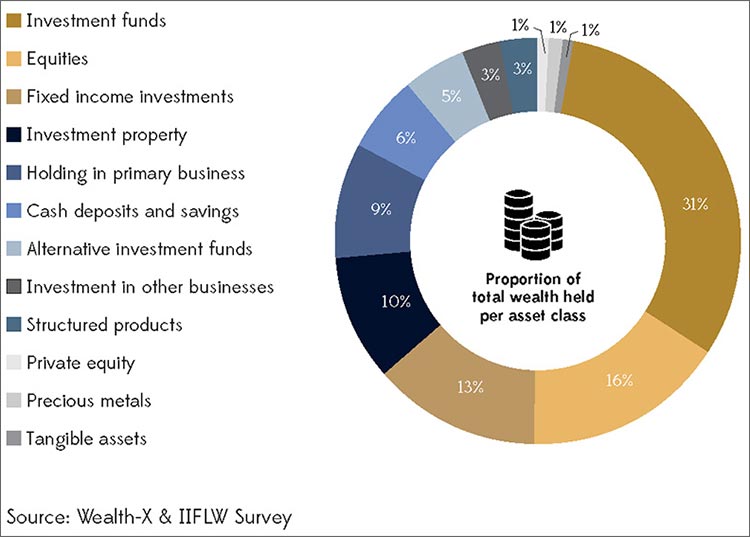

Investment funds make up almost one-third of the total assets held by the super wealthy.

HNIs seek to achieve growth via a spread of asset classes, the largest of which are investment funds, direct equity holdings and fixed income. But the very top tier of wealth-holders, the UHNIs, are more heavily invested in their own businesses, usually within India.

And with the Indian government focused on stimulating greater entrepreneurship, the super wealthy are keen to get in on the act and invest in those forging India’s economic future.

India’s wealthy also want their investments to pack a social punch at home and to be part of the story of strengthening India. This so-called impact investment is viewed as being on a par with philanthropy, which remains a major driver of social change in the country.

26% of investors to cut their real estate asset allocation.

Show me the money

India’s wealthy are careful to manage risk by adopting a diversified and sophisticated strategy for their financial investments. Their demand to make their money work harder means an asset portfolio shake-up is coming in 2018/19.

Those invested in equities are willing to take greater risks than those in any other investment class.

Intentions for wealth allocation in next 12 months

Switching assets seems to be a theme among wealthy Indians. An astonishing 48% of those already in investment funds plan to raise their allocation. Of those invested in equities, 46% similarly plan to increase their stakes while 45% want to do so in alternative investment funds. 26% of investors say they will cut their real estate asset allocation – the most dramatic of all investment decisions.