89% declared confidence in the future of the economy

Confidence is king for investors and India’s wealthiest people have it in abundance. Nine out of 10 of India’s wealthy elite are upbeat about the future of the Indian economy and this is sure to drive their choices about where they invest in the coming years.

Despite economic and political uncertainties on the horizon, India’s wealthy believe the future is bright not only for India but the world economy too. That confidence translates into a powerful sense of economic destiny, with 96% of those surveyed believing they will achieve their goals in the next five years. Their primary aim is pretty simple: achieving financial growth year in, year out.

One in five HNIs has no succession plan in place.

Staying wealthy

The domestic and geopolitical backdrop aside, what is the number-one fear of the wealthy? It’s quite simply losing their fortunes, so wealth preservation is paramount. Despite a burgeoning confidence in their ability to make money, two fifths of those surveyed said they were worried about losing their wealth.

Those whose primary financial goal is to increase their wealth are more trusting, with 78% prepared to hand decision-making to others.

Investment planning: asset rich, time poor

Brilliant at making money, India’s wealthy elite are out of their comfort zone when it comes to managing their wealth. An overwhelming 86% of wealthy Indians check on their investments regularly. Long working hours and the challenges of building up business empires means that 60% of the wealthy in India do not have time to manage their own investments.

The primary criteria for choosing a wealth manager is an investment company’s standing and track record.

Reputation

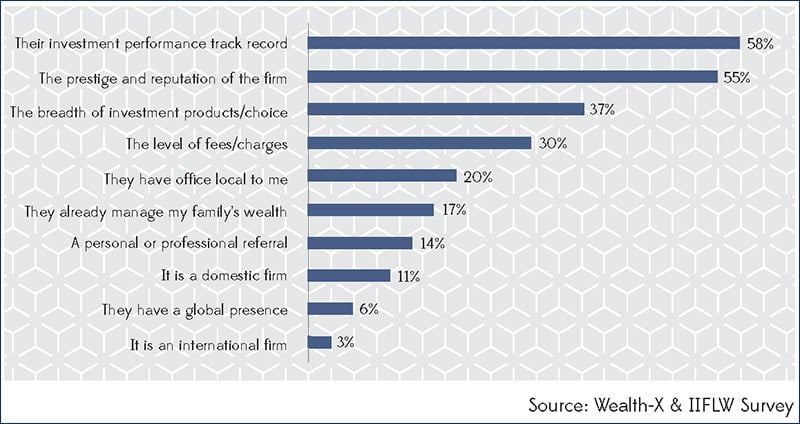

For the super wealthy, an investment company’s standing and track record are the foremost criteria when it comes to appointing a wealth manager. Outstanding investment performance was ranked first by 58% of India’s richest individuals when choosing the best person to manage their wealth.

Prestige and reputation of a firm is paramount for 55% of the wealthy. In other words, they want a world-class performer.

They also want an investment manager who offers the full portfolio of investment asset classes, with 37% citing this as a factor in their decision making.