Nifty50 Index is currently trading at ~19000, just above its all-time high levels registered last in December 2022. Beginning of the year, the index had slipped to sub-17000 levels in March’23 but has since rallied ~11% following risk-on sentiments. The index is up by ~4% in CY2023 to date. Notably, the rally has been sharper in the broader markets as indicated by BSE500, which has rallied ~13% since March ’23, led by c.20% gains in the mid & small cap segments. BSE500 is up by ~4.5% on a CYTD basis.

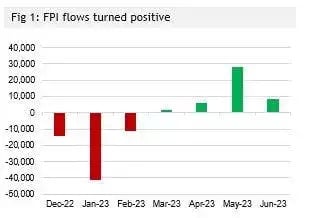

FPI flows into Indian equities have turned positive with the change in the macro narrative. After having been net sellers of INR ~520Bn in Jan-Feb 2023 period, FPI flows turned into a net positive of INR 440Bn to date. The recent upgrade in FY2024 GDP growth forecasts by Fitch to 6.3% (from 6% earlier), and stability in INR against USD and other major currencies, will likely be the supportive factors for FPI in-flows.

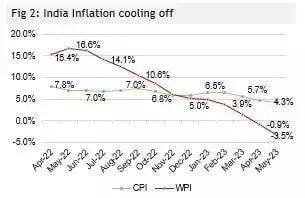

As the commodity prices weakened – on lower-than-expected demand from China opening – the markets quickly began to discount the higher possibility of stable - & rather - lower inflation print, which also entails the possibility of a rate cut towards the end of 2023. RBI has already hit the pause button over the last two MPC meetings so far in FY2024. This is very much in line with the US Fed’s actions as well.

India CPI inflation has cooled to 4.2% YoY in May’23. US & Euro CPI fell to 4% & 6% respectively, but core remains sticky at 5% levels. WPI inflation for India was recorded at (-)3.5% which likely will translate in lower CPI inflation over next few quarters.

The recent macro data supports the narrative of continuing strength in Indian equities. Surveys continue to indicate strong activity levels - Manufacturing PMI expanded further to 58.7 in May’22 (vs 57.2 in April), while Services PMI continues to stay above 60 for the 2nd straight month. Steady improvement is seen in CMIE consumer sentiment which is currently at 94.5 — its highest since the pandemic began. Both Urban and Rural sentiments have improved to 92.7 and 95.1 respectively.

Journey towards 21000

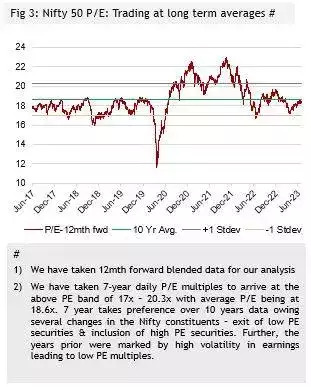

Indian equities are experiencing PE re-rating and have been supported by strength in global markets as well. At current levels, the index trades at 17.7x basis of its FY25E EPS of INR ~1060. The index earnings are likely to grow by ~16% on CAGR basis over the FY2023-2025 period. We envisage a continuation of the re-rating and expect the Nifty index to likely trade towards +1 Stdev. ~20+ P/E levels which translates into ~21000 print on index.

A supporting factor – apart from likely lower inflation readings, and stability in interest rates –would likely be the improvement in consumption demand even as capital investments continue to drive overall strength in the economy.

Pick-up in private consumption demand, which had weakened over the H2 of FY2023, is likely to remain subdued in the near term. However, the intensive investments, led by government expenditure, have historically been followed by a pick-up in consumption demand. A flurry of state elections later in 2023 followed by general elections in 2024 can also spur the consumption momentum as has been anecdotally experienced in previous election cycles.

The key micro drivers would likely help sustain emerging stability in the corporate earnings, driven first by improving margin as commodity prices, including crude oil, continue to weaken and pick-up in revenue as the macro environment improves. This could lead to a broader earnings upgrade as well, albeit with a lag and towards Q4 of FY2024.

The global macro backdrop is improving. High-frequency data in the US has been quite positive pushing the recession forecast by most analysts much later in the cycle. At the same time, US Fed is close to its peak in the rate hike cycle. While Europe and UK remain weak, we think the impact on Indian equities should be limited. Compared to this Indian economy has been quite resilient.

Technical overlay indicating strength

The Nifty 50 index on the Monthly time frame has been moving in a rising trend channel. In the past, it can be observed that the midpoint of the channel has acted as a support, excluding the 2020 pandemic fall. The ongoing rising trend channel & Fibonacci extension suggests that the rise can extend to 20600-21600 levels.

Global macro backdrop is improving

Currently Nifty 50 trades at current year P/E of 20x which is at a 1% discount vs US, marginally below its long-term average premium and 40% premium vs APxJ in line with the long-term average. While the valuation premium has expanded compared to China equities, we think it is justified given the weak macro backdrop in China.

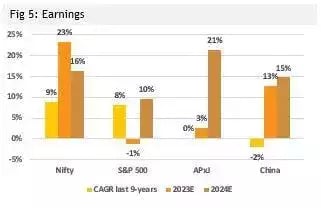

Earnings growth in India has been far superior compared to other Asian peers. Nifty has had an earnings CAGR of +9% in the last 9 years, compared to an earnings CAGR of -2.1% for China equities and +8% for US equities. Currently, our strategy analyst expects index earnings to grow 16.6% (annualized) for the next two years, a conservative estimate compared to a CAGR of 20% for BBG consensus. While most global markets, including India, saw margin contraction in the last few quarters driven by high commodity prices, we think this will ease out from here on. We think earnings alone can drive the performance of Nifty to 21,000 without the need for valuation re-rating.

High-frequency data in the US has been quite positive pushing the recession forecast by most analysts much later in the cycle. At the same time, US Fed is close to its peak in the rate hike cycle. While Europe and UK remain weak, we think the impact on Indian equities should be limited. Compared to this Indian economy has been quite resilient.

MSCI India’s weight has increased from c9% in 2020 (pre-Covid) to c.14% currently. While the underperformance of China equities drove the increase in weight, it was also further boosted by the removal of Russia, Pakistan and Argentina in the last couple of years. As the weight of India increases in major global indices, we think this opens the gate for higher passive flows in the country.

Read the original article:

ET Markets