Highlights:

-Wealth management industry on a growth path

-Regulations and technology can be disruptive

-IIFL wealth enjoys strong market position, business model undergoing transformation

-Near term profitability under pressure

-Valuations fair, only listed pure play wealth manager makes it a worthy bet in long term

India is one of the fastest growing wealth markets globally and is projected to grow at 10 percent CAGR for the next five years, according to BCG. Thanks to a burgeoning affluent class – also commonly known as high net worth individuals (HNWI)—those with wealth between $1 -20 million, India is the only nation apart from China which is expected to see double-digit CAGR in personal wealth. Upper and ultra-high net worth individuals (UHNWI) segment i.e. individuals with investable assets of $ 20 million or more, too is likely to see fastest growth in wealth.

No wonder then, the business of managing wealth is looking up and has become an attractive business model for many financial institutions in India. However, despite the golden opportunity some global heavyweights like UBS, Morgan Stanley, HSBC and RBS have exited the space. Even some remaining entities like Credit Suisse are struggling to maintain and grow their market share. The void created by the exit of foreign giants is being captured by homegrown players who have emerged as leaders. Domestic players now account for 77.5 percent of the Top 20 player’s asset under management, up from 64 percent in 2015 as per data by Asian Private Banker.

While the wealth space is mostly dominated by private banks, contribution of wealth business to these banks’ total profits remains miniscule. For instance, in the case of Kotak Mahindra Bank, the largest wealth manager in India, the bank still contributed to more than 60 percent of profits in FY19. Hence, the best way for investors to take an exposure to the wealth management industry is through a pure play wealth manager. IIFL Wealth Management – the largest non-bank wealth manager got listed last month following its demerger from IIFL Finance.

Business overview

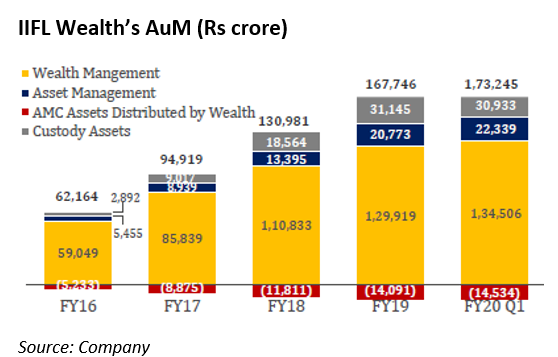

In less than a decade since inception, IIFL Wealth has catapulted to the position of third largest private wealth management firm in India, with assets under advisory (AuA) of Rs 1.34 lakh crore as on June 30, 2019. In 2018, IIFL Wealth acquired two other smaller wealth management firms, Wealth Advisors India and Altiore Advisors. Recently it acquired L&T Capital Market which came with assets of Rs 25,000 crore.

IIFL Wealth offers a full suite of services to clients, including distribution, advisory, asset management, broking, and lending. Under the asset management business, it offers alternate investment funds (AIFs) and portfolio management services (PMS). Asset under management (AuM) in the AMC business was Rs 22,339 crore as at end June.

Its wholly owned non-banking financial company (NBFC), IIFL Wealth Finance, had a loan book of Rs 4,615 crore, mainly consisting of loans against securities. The NBFC largely supports the wealth management business by providing loans to clients as a temporary bridge for their liquidity requirements. The company has over 300 relationship managers (RMs).

AuM growth to moderate in near term

IIFL Wealth’s total assets (including wealth and asset management business) grew at more 20 percent in past fiscals. However, we see asset growth slowing down to mid-teens in the near term due to volatile capital markets and subdued sentiments. IIFL Wealth has been aggressive in distributing high-fee generating alternative investment products like PMS. But it will be difficult to push such high-cost products in the current down cycle.

Business model undergoing transformation

IIFL Wealth is undergoing business transition forced by regulatory changes. Till 2017, income from distribution of mutual funds was received upfront. However, with SEBI completely banning upfront commissions, IIFL stopped upfront income recognition on mutual funds from September 2018. Further, it now accounts all distribution income including income from alternatives on an annuity or trail basis from 1st April 2019.

Also, SEBI’s decision to cap total expense ratio (TER) to 2.25 percent - the fees that mutual funds charges from investors every year to manage their money, has adversely impacted revenue of IIFL wealth as most AMCs have passed the cut by reducing distributors’ commissions.

In this backdrop, IIFL has launched IIFL One, its advisory platform that charges annual fees to clients but does not earn any commissions (upfront or trail) from the asset managers. The acceptability of this new model is critical. Contrary to popular argument, customers may be willing to pay wealth managers for better experience and from a client’s perspective experience constitutes performance, engagement and trust. However, the transition to an advisory model will take time.

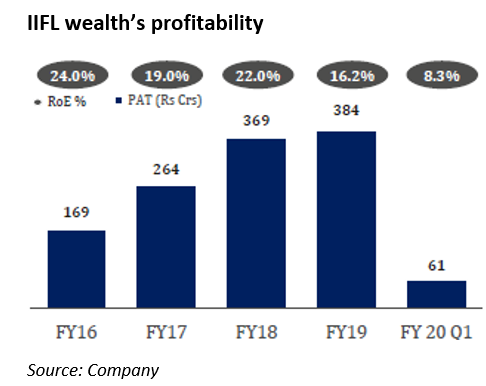

Near-term pain, but strong long term earnings visibility

IIFL Wealth’s transition to a trail-based and advisory model from FY20 will lead to immediate pressure on revenues and yields will moderate further. To manage profitability, the company may curtail operating expenses and reduce expense ratio by reducing the fixed pay component of RMs.

Overall, the business transformation will hit near term profitability and involves huge execution risks. So why should you still consider IIFL Wealth?

The business model transition will reduce earnings in the near term, but will lead to steady trail/regular income over time. With about half of IIFL Wealth’s assets in debt (49 percent in June 2019) investors can expect a steady growth in AuM even if equity markets are weak.

Wealth management industry on a growth path but vulnerable to disruption

Outlook for the wealth management industry is promising as the market has room to grow, along with India’s economic growth and rising income levels. Further, the wealth business is relatively ‘low risk’ and has certain inherent advantages compared to other financial services businesses. Wealth business requires limited capital for growth, so it can potentially generate non-linear profit growth and return on equity (RoE) expansion. Additionally, it provides cross-selling opportunities. For instance, large section of UHNWI clients globally use credit to enhance their returns. Hence, there can be opportunity to grow balance sheet with thrust on lending and credit solutions for UHNWI.

That said, regulations and technology can be disrupt wealth management business. In India, currently these risks seem less threatening but wealth managers need to adapt to a market environment that is always evolving. Global wealth management is undergoing unprecedented transformation mainly emanating from stricter regulations (such as Europe’s latest regulations like MiFID II) and technology developments. Back here, SEBI’s proposed investment advisor regulations, if implemented, can change business models and cost structures of wealth managers. SEBI has proposed a clear demarcation between an investment advisor and distributor, wherein a latter is someone who sells commission-laden mutual funds.

Reasonable valuations

We see IIFL Wealth’s business on a sustained growth path driven by a rising number of millionaires seeking wealth advice. Last year, IIFL Wealth raised Rs 746 core from marquee investors which valued its franchise at Rs 14,600 crore against the current market cap of Rs 10,200 core. Does that imply significant upside to the stock? Not really. Earnings is likely to be muted in near term which will limit the stock upside. At the current market price of Rs 1180, IIFL Wealth is trading at 26 times FY21 estimated earnings which is reasonable. Long term investors should start accumulating the stock on a further correction in stock price.

Read the original article:

Moneycontrol